Getty Images

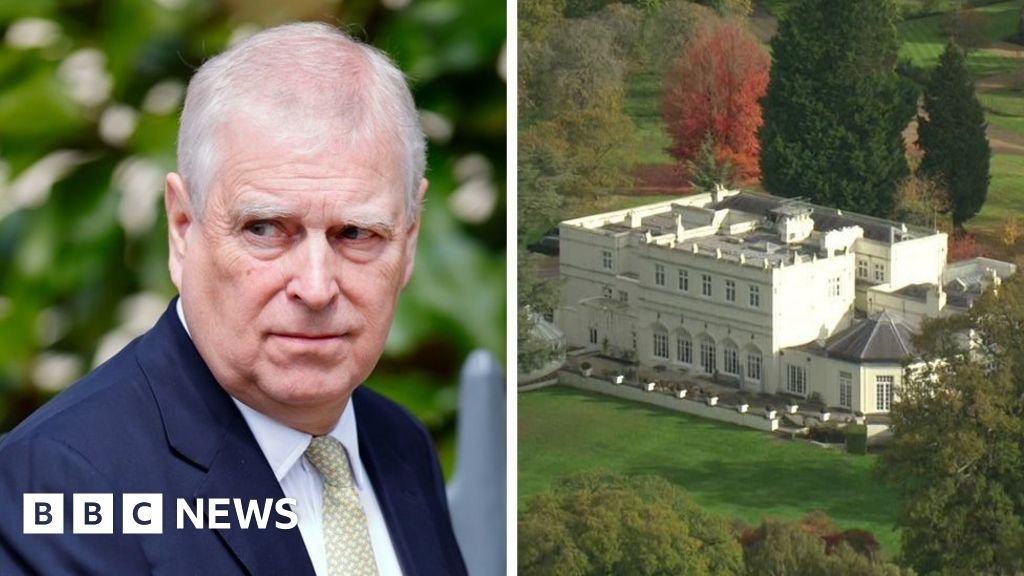

Getty ImagesAndrew Mountbatten Windsor is expected to be dependent on his brother, King Charles III, for his home and money after being stripped of his “prince” title and asked to leave his mansion, Royal Lodge.

The Royal Family receives tens of millions of pounds each year from the Sovereign Grant, but this is not the King’s only source of income.

How much is the Sovereign Grant?

In 2025-26, the Sovereign Grant, which provides state funding for the monarchy, increased to £132.1m, following a sharp rise in profits for the Crown Estate.

The figure for 2024-25 was £86.3 million, for the fourth consecutive year.

That included £51.8 million for the core Sovereign Grant and £34.5 million towards the modernisation of Buckingham Palace, a 10-year £369m project.

The Royal Household’s annual financial statement said additional income increased to £21.5m, following a record number of visitors to Buckingham Palace.

Public funding for the Royal Household has tripled in real terms since 2012, official figures show. The Sovereign Grant was £31m per year when it was introduced in 2012.

A report by the House of Commons Library said much of the increase had been driven by the Buckingham Palace project.

A Palace spokesperson said: “It has always been anticipated that the level of the Sovereign Grant will drop once the project is completed.”

How is the Sovereign Grant worked out?

Profits of the Crown Estate – a property business owned by the monarch but run independently – go to the Treasury.

The level of profit is used to calculate the funding given by the government to the Royal Family.

The Crown Estate had assets worth £15bn in 2023-24, with billions of pounds worth of properties in London, including Regent Street, as well as nearly half the land along the coast of England, Wales and Northern Ireland.

The estate is not the King’s private property – it merely belongs to the monarch for the duration of their reign. The King cannot sell its assets or keep any profits for himself.

The Sovereign Grant was initially worth 15% of the Crown Estate profits generated two years previously. That increased to 25% in 2017-18, to help pay for the Buckingham Palace repairs, before reducing to 12% since 2024-25.

However, soaring profits from the Crown Estate due to six new offshore wind farms still led to the £45m increase in the Sovereign Grant in 2025-26.

Under the Sovereign Grant Act 2011, if the Crown Estate’s profits fall, the monarch still receives the same amount as the previous year, with the government making up the difference.

The UK government said that over the last 10 years, the revenue received from the Crown Estate was £5bn, which was used for public spending.

What is the Sovereign Grant spent on?

The King and other working members of the Royal Family use the money to pay for expenses related to their official duties.

The vast majority is spent on the upkeep of properties and staffing, but it also covers costs such as travel to royal engagements.

Members of the Royal Family carried out 1,900 engagements across the UK and abroad during 2024-25.

More than 93,000 guests attended 828 events at official Royal palaces, including receptions, award investitures and garden parties.

How else does the Royal Family receive money?

The King also receives money from a private estate called the Duchy of Lancaster, which is passed down from monarch to monarch.

It covers more than 18,000 hectares of land in areas such as Lancashire and Yorkshire, as well as property in central London.

At the end of March 2025, it was worth £679m and had made £24.4m in annual profits.

Whoever holds the title of Duke of Cornwall (currently the Prince of Wales) benefits from the Duchy of Cornwall.

It mainly covers land in south-west England. In the year to the end of March 2025 it had assets worth £1.1bn and had made annual profits of £22.9m.

The King and Prince William receive the profits from the duchies personally, and can spend them as they wish. However, they are not entitled to any proceeds from the sale of any estate assets, which must be reinvested.

Getty Images

Getty ImagesThe monarch also owns the royal palaces (which are not part of the Crown Estate) and part of the Royal Collection of art, but these do not generate income.

Some palaces are looked after and funded by the Royal Family itself. Others – such as the Tower of London – are managed by Historic Royal Palaces, an independent charity.

The Royal Collection is also run by a charity, the Royal Collection Trust, which reinvests income received from ticket sales and retail outlets.

The King also privately owns properties such as Balmoral and Sandringham.

It is understood Andrew will be relocated to the Sandringham estate in Norfolk, but details about his housing have not been released. The estate covers approximately 8,100 hectares with 242 hectares of gardens.

In addition, some Royal Family members have private art, jewellery and stamp collections which they can sell or use to generate income as they wish.

Do members of the Royal Family pay tax?

In 1992, Elizabeth II volunteered to pay income tax and capital gains tax on her personal income, and the King does the same.

The two duchies are exempt from corporation tax, but the King and Prince William voluntarily pay income tax on the revenue they generate. However, the amount of tax they pay is not made public.

They do not pay capital gains tax because they do not benefit personally from any increase in the duchies’ assets.

Members of the Royal Family pay tax on any income generated from privately-owned assets.

King Charles does not have to pay inheritance tax on the money he received when the late queen died, under the “sovereign to sovereign” exemption agreed in 1993 by then Prime Minister John Major.

Getty Images

Getty ImagesWhat about security and other costs?

The Sovereign Grant does not cover the Royal Family’s security arrangements, which are usually paid for by the Metropolitan Police, although the cost is not disclosed.

Major events are also not included. The late queen’s funeral in 2022 cost the government an estimated £162m.

The Coronation of the King cost taxpayers £72m, including £22m for policing.

Republic, a group campaigning for an elected head of state, have argued that factors such as security need to be included in the cost of the Royal Family.

The group claims that the total cost of the monarchy is about £510m per year.